In simple terms, blockchain is a systеm for storing and accounting for the value that cryptocurrency represents. And if you want to own and manage that kind of value, you need access to it.

A cryptocurrency wallet is a kind of bridge between each individual user and the blockchain, giving you the ability to manage your personal funds in digital assets.

In our review, we will cover the topic of cryptocurrency wallets: what they are, what to look for when choosing a cryptocurrency wallet, and how to ensure security when using them.

What is a cryptocurrency wallet?

A cryptocurrency wallet is a piece of software or a separate device used to access and transact with cryptocurrencies.

Depending on the user’s goals, he or she can have an unlimited number of wallets. Typically, a person who uses cryptocurrencies for active investing and trading has multiple crypto wallets designed for different tasks.

Using the cryptocurrency wallet interface, you can see the balance of your cryptocurrencies and perform necessary transactions with them. Contrary to popular misconception, they do not store assets. Rather, they are designed to store private keys that give you access to the blockchain that stores your funds. As such, wallets provide the ability to interact with blockchain networks using specially generated encrypted data to conduct transactions.

Cryptocurrency wallets are based on a cryptographic protocol that uses digital keys to sign transactions and confirm ownership. The functionality of a cryptocurrency wallet is tied to two key components:

- A public key;

- A private key.

The private key is a randomly generated set of 256 characters that is nearly impossible to capture or rewrite without error. A seed phrase can also be used instead of or in conjunction with a private key.

They are the main target of scammers and thieves who want to get their hands on your assets. If you know the private key and the seed phrase, you have access to the funds.

A user’s wallet is externally identified by a public address. It defines the location of the wallet and is also a combination of symbols. The address can be in the public domain, it is used by other users to send funds to it.

Cryptocurrency wallets: types and features

Through the interface of your wallet, in addition to conducting transactions with cryptocurrencies, you can confirm your identity, get access to communities, DeFi tools and other useful features.

Cryptocurrency wallets can be accessed through a browser, desktop, mobile apps, and individual electronic devices that can operate autonomously.

A cryptocurrency wallet can be designed specifically for a particular digital asset, or it can be multi-currency, supporting a variety of cryptocurrencies.

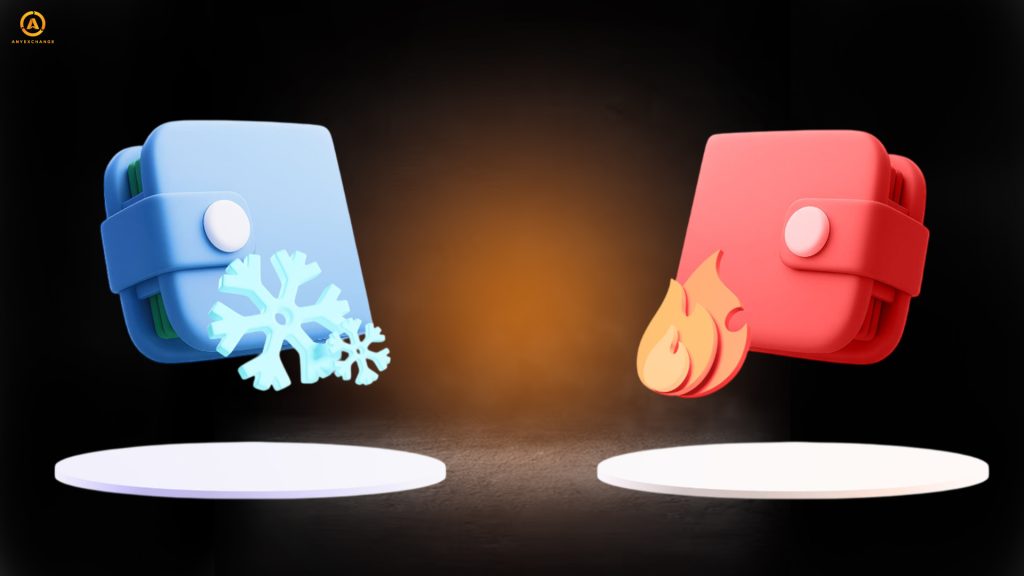

The most popular classification of cryptocurrency wallets is to divide them into two types: cold (working without a network connection) and hot (requiring an internet connection).

Let’s take a closer look at them.

Hot and cold wallets: what is the difference?

The main difference between hot and cold cryptocurrency wallets is that if you prioritize the safe storage of cryptocurrencies, you should choose the second between hot and cold storage. Hot ones have a wider range of features, while cold ones have better security features.

Cold (hardware) cryptocurrency storage wallets do not require an Internet connection, and you can hide them in a safe or safe deposit box under seven locks. They can be presented as a separate media or in paper format with a printed QR code. This keeps your private keys permanently off the Internet and out of harm’s way, with no exceptions except for force majeure.

This allows you to physically limit unauthorized access to your proprietary assets. And it is the increased security that is the main benefit of cryptocurrency cold storage. And if you need to store large amounts of cryptocurrency over a period of time, such as a long-term investment in bitcoin or ethereum, cold wallets are the perfect solution. Setting up and using hardware wallets does not require any special technical knowledge, so they can be used even by a novice investor who wants to earn passive income over the long term. At the same time, they are convenient for frequent use. The most popular examples of this type of solution are Ledger, Trezor, Safepal, CoolWallet and Tangem.

Hot wallets, on the other hand, as applications or programs connected to the Internet, have many features that are described in detail in numerous reviews of popular hot wallets. They are used for trading on stock exchanges, regular transfers, making transactions and using various DeFi tools. You can use online solutions from any device you have at hand while you are anywhere in the world. They are also convenient in that you can contact technical support at any time in case of the slightest difficulty. They are the main tools of professional traders as they require certain knowledge and skills to use. There are many on the market: Coinbase Wallet, Exodus, Mycelium Wallet, Atomic Wallet, Trust Wallet and many others.

Online Wallets vs. Offline Wallets: What to Choose

Before choosing a cryptocurrency wallet, it is necessary, first of all, to determine your own preferences and the tasks you set for yourself in interacting with crypto assets.

- Level of security. Physical isolation of private keys from hacks and hacker attacks is ensured only by cold (hardware or paper) solutions that incorporate the best security practices of cryptocurrency wallets. Read the opinions and recommendations of users, study reviews of the best hardware wallets 2024 and make the right decision.

- Usability. For frequent transactions, online tools with a wide range of features are definitely better. You can buy or sell digital assets whenever you need to.

- Volume of financial transactions. If you are a large long-term investor and your plans do not inсlude using your crypto savings in the foreseeable future, as you know how to wait and want to get a tangible income in the future, then safe storage of bitcoin and other cryptocurrencies in large volumes should be provided only with the help of cold crypto wallets.

- Multicurrency. Support for specific cryptocurrencies is also an important consideration when making a choice. The wider the range of compatible digital assets offered — the more functional it is.

How to create a secure cryptocurrency wallet

- Decide on the type of wallet that best suits your goals.

- sеlect a reliable service provider.

- Download an application/program or set up hardware.

- Create an account, obtain private and public keys for further use.

- Think about how to ensure the security of your cryptocurrency wallet. Contact experts and get recommendations on how to store private keys to protect your cryptocurrency assets. Basic advice on how to protect your cryptocurrency wallet from hacking or hacker attack is usually backup. Copying keys and cid phrases, followed by encryption, will ensure that you have access to your funds even if you lose your hardware media.

- Add funds and perform transactions. To send funds, you need to specify the recipient’s address and amount, followed by confirmation with a private key.

Cryptocurrency Security: Tips and Advice

The sphere of digital assets is subject to high risks of hacking and other fraudulent actions. Therefore, it is necessary to follow certain rules when using cryptocurrency wallets.

- Download only official versions of programs and applications from verified, authorized sources.

- Choose reputable service providers with a successful history and a large user base.

- When using hot wallets, do not ignore the security rules for the devices on which they are installed. It is necessary to regularly check laptops, computers and smartphones for viruses and malware.

- Do not share passwords and private keys. Keep them as private as possible.

- Make encrypted backups of passwords and private keys.

- Store private keys and backups in a safe place.

- Use two-factor authentication and any other possible methods offered by software or application developers. Do not ignore additional security methods each time you log in.

- Do not send money to unknown users at suspicious addresses.

- Keep track of available updates and install them in a timely manner. Developers are constantly improving encryption methods to minimize the risk of unauthorized access to user assets.

- Respond quickly to incorrect data displayed in your wallets. For example, in December 2024, the developers of one of the most popular wallets, Trust Wallet, fixed a bug that caused users’ balances to appear and disappear. Users wrote that their funds were “periodically disappearing”. And some complained that they “almost had a heart attack”. However, such strange phenomena can be not only an indicator of a systеm error, but also a sign of unauthorized actions performed with your assets by unidentified malicious individuals.

- Try not to keep all your savings in one wallet, distribute them. This will reduce the risk of losing your entire capital if you lose one of them.

Conclusion

The exponential growth in the popularity of cryptocurrencies requires efficient and secure mechanisms for managing and storing digital assets. A cryptocurrency wallet is your right hand in dealing with digital assets. With its help you will be able to manage your cryptocurrency capital according to the goals you set. Its proper use, in compliance with all necessary security rules, will allow you to ensure the safety of your money.

When choosing a wallet, take into account its convenience, the availability of the necessary set of options, the range of supported cryptocurrencies and, above all, the level of security. Ensure that your private keys are stored securely.

Increase your awareness and stay abreast of new cybercrime techniques and approaches. Their number, speed, boldness and sophistication are increasing year by year as the cryptocurrency sector evolves.

Thank you for reading our article. Invest safely and profitably!

AnyExchange is a cryptocurrency exchanger that has been successfully operating in the international financial market for more than 5 years. With the help of our service you can exchange digital assets for electronic or cash money at the most favorable exchange rate. We work with the most popular payment systems and conduct transactions using bank cards. The platform also offers fast money transfers all over the world.