In cryptocurrency trading, instant reaction can be crucial. Experienced traders know how to make a profit within minutes. And when it comes to bitcoin trading, for example, such trades can yield more than substantial income.

Being a successful crypto trader is not just a matter of luck. In the volatile cryptocurrency market, a short-term transaction must be executed according to all the rules, and then it will lead to amazing results.

Short-term cryptocurrency trading aims to buy and sell assets in a short window of time, from seconds to a few days. Its focus is not on holding the asset, but on making a trade at a favorable moment when there will be price fluctuations and market liquidity, promising maximum quick profits.

And if in long-term investing decisions are based on fundamental analysis of projects, short-term traders rely more on technical analysis tools and selection of profitable entry points.

Let’s take a look at the basic concepts of short-term trading in digital assets, trading strategies used by traders, their advantages and risks.

Short-term cryptocurrency trading

Cryptocurrency trading is one of the most actively practiced forms of investment in recent years. The rapid rise of bitcoin, ethereum and other altcoins has attracted the interest of thousands of beginners who have decided to try their luck in crypto trading. At the same time, short-term cryptocurrency trading is a high-risk instrument used in a highly volatile market. It requires certain technical skills from the trader, but not only that. The second key skill that a person trading cryptocurrencies should possess is the control of emotions. Usually a trader makes mistakes because of fear or greed. It could be confusion when the price drops sharply, or it could be entering a trade prematurely when the value suddenly jumps. In both cases the trader can lose money. Therefore, in order to achieve success and profit, it is necessary to clearly adhere to the chosen strategy and be ready to always stay in control and not get emotionally involved.

Short-Term Cryptocurrency Trading Strategies

In essence, a trading strategy is a set of rules based on which the trader makes certain decisions. A trading strategy consists of the following components

Short-term cryptocurrency trading means holding positions for a period ranging from seconds to weeks. Depending on the chosen strategy, a specific time frame is used:

Let’s take a closer look at other types of trading strategies as well.

Arbitrage Trading

Arbitrage is based on the difference in the price of a crypto asset on exchanges or trading platforms. An arbitrage trader monitors cryptocurrency prices on different platforms, finds the lowest price and then sells it for a quick profit. Because the cryptocurrency market is highly fragmented, it offers a wide range of opportunities for arbitrage trading.

Range Trading

It is based on support and resistance levels. Support is the point at which the price of an asset stops falling and starts rising. Resistance is the level at which the price of the crypto asset stops rising and begins to fall.

Information about the occurrence of these levels gives the trader the opportunity to make a decision to buy or sell cryptocurrency. In this trading strategy the factor of correctly chosen moment is of paramount importance: the trader must know that the ideal time in the market has come, the asset has frozen at a certain point and it is possible to make a transaction. Here, the slightest mistake in predicting price fluctuations can lead to financial losses.

Dollar Cost Averaging

This strategy allows cryptotraders to level the problem of choosing the time to enter the market and reduce the impact of cryptocurrency volatility. Its essence is that investments are made in fixed amounts over a certain period of time. In this way, you can avoid the mistake of making a large one-time investment at the wrong time. The main difficulty is to determine the exit strategy and profit targets, tracking oversold and overbought zones. Usually DCA bots are used for value averaging strategy trading, which automatically execute transactions.

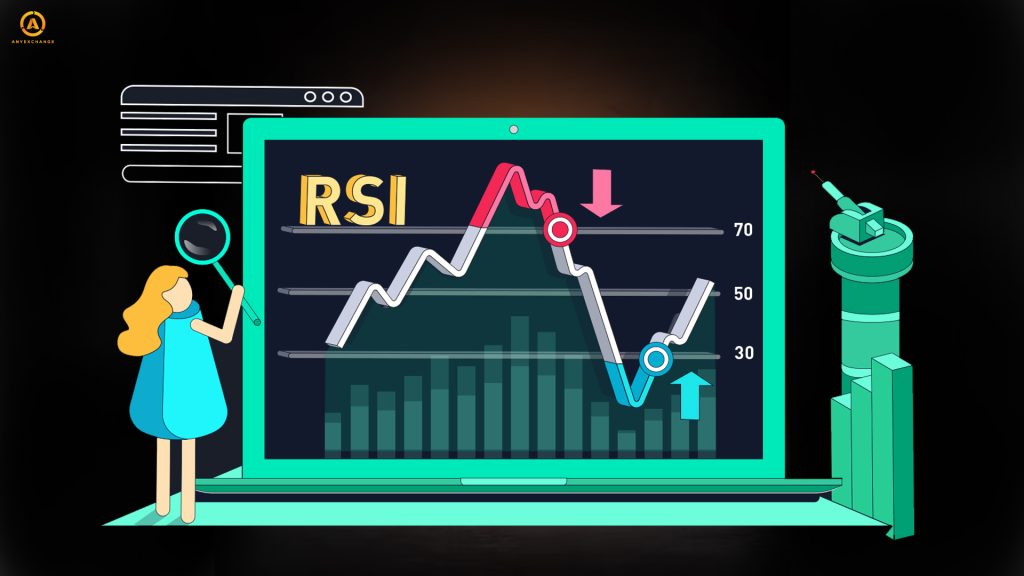

Cryptocurrency Trading Strategy with RSI Divergence

This strategy uses the RSI oscillator indicator, which shows the strength of the current trend on a scale from 0 to 100.

The divergence between the price movement of the crypto asset and the RSI is taken into account. If the value of the asset reaches a new high and the RSI does not, the divergence is recorded. This indicates the weakness of the current trend and the imminent reversal. If the divergence is positive, a purchase is made. At this point, the value of the asset falls below the previous minimum and the RSI forms a higher minimum.

That is, the essence of the strategy is that the RSI divergence gives the opportunity to see the weakness of the current trend in advance, in order to enter the opposite position in time. Stop Loss orders (used to limit losses in case the price goes in the wrong direction) are placed above or below the last price extremum.

Hedging

This is a risk management strategy that allows you to prevent the negative impact of the upcoming decline in the price of cryptocurrency. In this case, the investor opens a short position to sell the asset at its current value in anticipation of its decline. This creates an opportunity to buy the asset at a lower value and make a profit on the difference. This profit offsets any losses on the original positions.

Tools for Short-Term Cryptocurrency Trading

In a world of rapidly evolving technology and a volatile cryptocurrency market, a trader must be comfortable with the way things work. Having effective tools at your disposal can make all the difference and save you from mistakes and financial losses. When developing your trading strategy, be sure to consider the following tools

Trading Psychology

It boils down to a simple thesis – control your emotions and have patience. Emotional trading leads to financial losses, and a trader’s job is to make money, not to lose it. Do not let fear or greed get the better of you. Only in a calm state of mind will you be able to make the right trading decision and continue on your path to success. Control your emotions, stick to the chosen trading strategy and you will achieve excellent financial results.

Conclusion

Short-term cryptocurrency trading presents a unique combination of opportunities and challenges. The dynamics of the market create all the conditions for capital growth, but can also be the cause of disappointment and losses. Short-term trading requires not only knowledge, but also the ability to feel the pulse of the market, to make decisions under conditions of complete uncertainty, and to control emotions. If a trader possesses these skills, almost unlimited horizons of opportunities open up before him.

Thank you for your attention. Invest safely and profitably!

AnyExchange is a cryptocurrency exchanger that allows you to convert digital assets at the most favorable rate. There are over 100 currency pairs on the platform, we conduct transactions both electronically and in cash. The service is represented all over Ukraine and abroad. Through our website you can make fast money transfers all over the world.