Major analytical services companies consider the tokenization of real assets as one of the most promising long-term trends in the blockchain segment. The number of token holders of RWA projects is increasing several times a year. The blockchain value of tokenized assets involved in DeFi grew by 70% last year, and reached the $2.5 billion mark.

What is the essence of tokenization of real assets? What is the impact of this trend on traditional markets and why is it growing so fast? What are the prospects for the tokenized assets market?

These and other questions related to real assets in cryptocurrencies are answered in our article.

The essence of the concept

Asset tokenization is a blockchain ecosystem tool designed to convert real assets into tokens. The class of cryptocurrency tokens formed after this conversion is called RWA (Real World Assets). RWA tokenization is a bridge between TradFi and DeFi. Thanks to this digitalization tool, tangible and intangible real assets with a certain off-chain value become available in the decentralized finance ecosystem, thus opening new horizons for their application, reducing costs and increasing the efficiency of funds management.

How RWA digital tokenization works

There are three main stages of tokenization of real assets when they are transferred to the digital decentralized landscape:

What types of assets can be tokenized?

In theory, anything, both tangible and intangible. Any asset can be tokenized if the information about it can be formalized and fixed in the form of a code.

The RWA market is still in the early stages of its development, and different types of assets have specific characteristics, making it easier to tokenize some assets and more difficult to tokenize others. Nevertheless, the sector has already managed to divide into categories of projects that are related to the general trend in RWAs. Here are the most capitalized of them:

The current ecosystem also includes the tokenization of precious metals, real estate, insurance, and agriculture. The green certificate category, which incentivizes manufacturers to reduce harmful waste, is gaining momentum, as is the intellectual property sector.

RWA market. Why is tokenization gaining traction?

Analyst firms estimate that the TVL (total blocked value) of the Real World Assets segment will exceed $2.5 billion by the end of 2023. This data is roughly in line with the Federal Reserve’s report that this figure was $2.15 billion last September.

In terms of capitalization, the difference in numbers is much more significant: CoinGecko estimates it at around $3 billion at the time of writing, while CoinMarketCap puts it at over $39 billion. The difference in data is due to the fact that not all protocols are included in the databases of analytical companies, and the information is constantly updated.

Development dynamics of the RWA sector

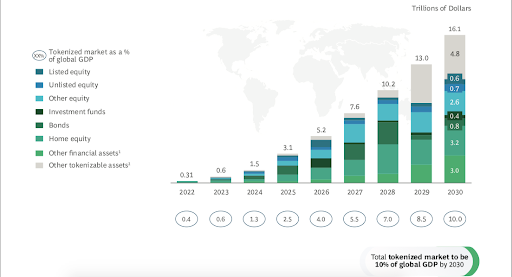

Analysts of Boston Consulting Group predict that by 2030 the capitalization of the sector may grow to $16 trillion and reach 10% of the world GDP.

Graph of market capitalization of real assets by categories according to BCG:

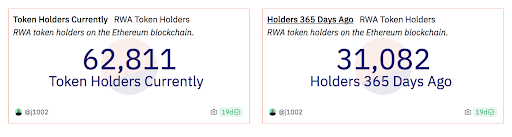

In 2022, RWA was highlighted by experts in analytical reports by PwC, Binance and Coinbase as one of the most promising trends in financial innovation in the blockchain industry. In 2023, a minimum of 25 protocols were included in the ecosystem, and it ranked among the top 10 in terms of blockchain funds in smart contracts. The number of RWA project token holders on the Ethereum blockchain has doubled over the past year.

Number of RWA token holders on Ethereum (Dune data at the time of writing):

Reasons for the growth

The first Real World Assets appeared in some form in 2018, but were not taken seriously by the market until the end of 2022. What is the reason for the surge of investors’ and developers’ interest in the sector?

Experts explain it, first of all, by a prolonged downtrend: after tripling from its peak in 2021, the market capitalization remained at the level of about $1 trillion for more than 12 months. The result is a record drop in trading volumes on DEX, an outflow of funds from DeFi (total TVL decreased by more than 4 times) and a significant decline in the capitalization of stablecoins.

Accordingly, the crypto market is looking for money, and the DeFi segment is looking for new sources of liquidity. And RWA instruments provide an opportunity to saturate the crypto market by using the potential of the traditional financial systеm.

The second important factor is the gradual adoption of decentralized systems by the banking and classical financial environment and the growing popularity of blockchain technology in investments. Last year, SWIFT tested the transfer of tokenized assets between networks, payment giant PayPal issued a stablecoin, and VISA released a solution for paying on-chain fees in fiat money. More and more blockchain platforms are becoming the basis for launching and servicing securities tokenization, digital currency issuances and cross-border banking transactions.

The most prominent platforms

Benefits of RWA to the cryptocurrency ecosystem

The function of RWA is to combine DeFi and TradeFi tools to create better trading mechanisms, speed up and cheapen its process, and optimize risks. Thus, the main advantage of tokenization of real assets can be considered as the optimal combination of centralized and decentralized finance in order to improve both spheres.

Some of the undeniable strengths of RWA inсlude the following:

Risks and disadvantages

Development prospects

It can be safely predicted that companies that have experienced a liquidity crisis as a result of the last “cryptowinter” will focus their efforts on RWA. The value of the global market, calculated in hundreds of trillions, contains huge reserves of untapped liquidity. And if at least a small part of it moves to the blockchain, the seemingly overly rosy prediction of the Boston Consulting Group that the RWA market will grow to $16 trillion by the end of this decade has every chance of coming true.

We can already say that the crypto sector has successfully overcome the period of confrontation with traditional finance, and today it positions itself more as a partner and provider of effective infrastructure for modernization and optimization of the classical financial systеm.

Thank you for your attention!

With AnyExchange exchange , you can convert cryptocurrencies at the most favorable exchange rate . Worldwide money transfers are available on the website.