Blockchain and artificial intelligence have long been considered incompatible technologies. Due to technical and conceptual differences, they developed independently for many years with little overlap. The exception was a few projects that were heavily criticized and did not attract much investor interest.

Recently, however, the situation has changed dramatically.

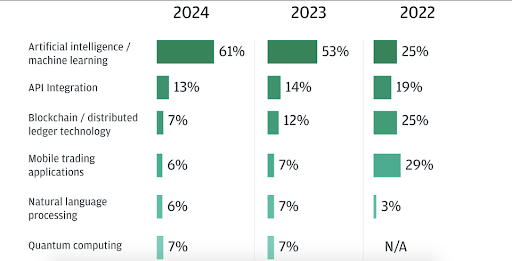

According to the results of a large-scale survey of institutional traders conducted by financial conglomerate JPMorgan in early 2024, the future of trading in the next three years will be determined by artificial intelligence and machine learning technologies. More than 4,000 firms from 65 countries participated in the annual survey, and 61% of respondents hold this view. This figure represents an increase of 8% compared to 2023. It is also interesting to note that institutional investors have become more cautious about other technological innovations in trading.

In other words, despite all the discussion about the unethicality and even danger to humanity of artificial intelligence, the technology and its derivatives are gaining more and more trust from large companies that are professionally engaged in investment activities.

At the same time, crypto experts do not tire of calling for caution when using the combined technologies of blockchain, AI and cryptocurrencies. In particular, Vitalik Buterin, co-founder of Ethereum, in his recent article spoke about the need to pay special attention to the gradual introduction of artificial intelligence into crypto, integrating it with proven blockchain systems and familiar interfaces with great care. In his opinion, “pure AI interfaces are too risky at the moment, as they increase the risk of new types of errors”. At the same time, the programmer recognizes that the areas where AI and machine learning technologies have the most potential are in the analytics and predictive markets.

Let’s find out how and why cryptocurrency data is analyzed, and what role artificial intelligence and machine learning play in crypto analytics and predicting the success of crypto projects.

The importance of analytics in the cryptosphere

The cryptocurrency sector is a large, high-tech, and fast-growing industry. Even the highest expertise and deepest experience of an individual trader or investor may not be enough to make the right decision in a highly volatile and unpredictable environment.

There are several methods of analyzing cryptocurrencies that can help you make profitable and secure decisions, with varying degrees of success. Here are some of them:

Technical Analysis

This is the basic method of analysis. It focuses on the study of price charts and the use of various indicators to predict the movement of an asset or market. The main task is to identify favorable prices (time periods) to buy or sell cryptocurrency. Technical analysis is based on detailed accurate past and present data and trends of the asset, while ignoring fundamental factors.

Fundamental Analysis

Fundamental analysis works on the intrinsic value (worth) of a cryptocurrency rather than the price. It is based on economic, financial, political and other factors that may affect the cryptocurrency. For example, the risk of an asset being banned in a certain jurisdiction will definitely affect its value. Taking into account the relative “youth” of the crypto market compared to the stock market (which is more than 100 years old), we can conclude that the opportunities for fundamental analysis in this segment are limited due to insufficient data. Therefore, traders often work on the assumption that the results of technical analysis are sufficient to determine a profitable trading strategy and make relevant forecasts for the cryptocurrency market.

Social Analysis

Social signals in the crypto world can also have a significant impact on the rise or fall of assets. Hot discussions about a coin in the community influence its price movement trends. This method has practical applications when analyzing cryptocurrencies that evoke an emotional response or exchange of opinions among the community. Examples inсlude the now legendary NFT collections of “bored monkeys” or meme coins of dogs, kittens and frogs that capture the attention of the entire market.

Data Analysis and Artificial Intelligence. The differences

Both terms combine techniques and tools to understand and use digital data. In today’s world, huge amounts of heterogeneous data on all aspects of human life are accumulating in the form of numerical, textual, audio, video, and other types of data. All this big data can be analyzed using statistical methods and technologies to draw meaningful conclusions. At this point, the functions of data analysis can be considered complete. Artificial intelligence, on the other hand, goes further. It uses the obtained analytical base to solve cognitive tasks that were traditionally available only to human intelligence. In particular, the ability to learn.

Machine Learning (ML) is a subset that combines data analytics with artificial intelligence. This technology uses algorithms and statistical models to analyze data to intelligently identify patterns and make predictions. Machine learning techniques are increasingly being used to create algorithms to automate cryptanalysis and optimize trading strategies, fulfilling roles previously reserved for humans.

Machine learning is being used to work with big data of blockchains, and cryptocurrencies are an ongoing subject of study.

Advantages of using AI to analyze crypto projects

The convergence of two advanced technologies has many benefits for both. First and foremost is increased security and efficiency.

The main advantage of the symbiosis of AI and blockchain in the context of this article is to improve the quality of decision-making. In addition to eliminating the emotional factor, artificial intelligence is able to process huge amounts of data in real time, draw conclusions and formulate detailed recommendations for traders and investors. It provides the following practical benefits when trading digital assets and investing in crypto projects

- Automation of analysis and prediction processes. Artificial intelligence performs processing of cryptocurrency data according to specified parameters. Technical, fundamental, social and other types of analysis are performed in minutes. Based on the patterns identified, traders and investors are provided with summary information to evaluate trading and investment opportunities and make informed decisions.

- Real-time customization and alerts. Trading and investing with AI models allows you to customize your business process to meet individual needs or trading strategies, and alert users when price levels are reached or other events occur that they want to be aware of.

Implementation Challenges

Ecosystem Overview

Developers have been working on the underlying technologies for decades. Since 2017, several dozen projects have been launched at the intersection of blockchain and AI, but investor interest has been relatively low. AI and cryptocurrency trading have only recently begun to converge rapidly, thanks in large part to large-scale language models such as ChatGPT. And today, the scope of machine learning and AI is growing rapidly in many aspects of the cryptocurrency industry.

The AI ecosystem in cryptocurrencies can be roughly divided into two groups: intelligent registries to solve internal tasks in the blockchain, and services that use AI to provide various services to users.

Among the projects that use AI to automate trading and asset management are platforms such as Fetch.ai, CryptoPrediction, WalletInvestor, and TradingBeasts. Such platforms, using sophisticated machine learning algorithms:

Effective use of artificial intelligence makes the crypto industry more understandable and attractive for users, and simplifies their interaction with it. Large investors are increasingly willing to invest in projects that use AI. As further research and development continues, the link between AI and blockchain will only become stronger. We hope this will have an extremely positive impact on the development of both technologies.

Thanks for your attention. Use the most advanced cryptocurrency analysis platforms to make the right decisions when investing and trading!

AnyExchange is a multi-functional international exchanger that allows you to convert cryptocurrencies at the latest exchange rate . The platform offers secure cash transactions and fast money transfers worldwide.