If you have been in crypto for a long time, you have probably heard that when launching a new project, its creators ambitiously called it something like “Ethereum killer” or “Bitcoin killer.” But of course, no one was able to kill anyone.

The Hedera team decided to go a different way, and without undue modesty, dubbed their brainchild the “blockchain killer”.

Did Hedera Hashdraph succeed in killing the blockchain?

AnyExchange team did their own research and found this out.

So, let’s take a look at this Hedera Hashgraph vs Blockchain duel!

What is Hedera Hashgraph?

Hedera Hashgraph is a public network based on distributed ledger technology designed for businesses and companies as a platform for decentralized services and applications.

Hedera positions itself as a third-generation public network — the next stage of Bitcoin and Ethereum development. The project’s strengths inсlude high scalability, security, smart contracts, energy efficiency, and low usage fees.

How is Hedera different from other projects?

Blockchains like Bitcoin and Ethereum have an important limitation that slows down their adoption in others sectors. This is the scalability problem: a critical decrease in throughput and transaction speed with a significant increase in transaction volumes.

Hedera Hashgraph vs Bitcoin

For example, Bitcoin blockchain can process up to 7 transactions per second (TPS), while Ethereum can process 20 TPS. PayPal or Visa have much higher throughput: 200 and 56,000 TPS, respectively.

This is exactly the problem that Hedera Network volunteered to solve!

As a solution to this problem, Hedera developers presented their vision of overcoming this problem – the DAG algorithm. What is it? How does it work? Let’s dive deeper!

What is DAG?

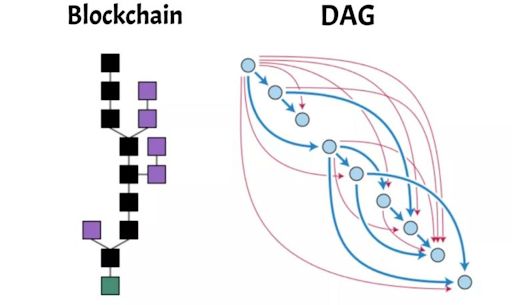

The Hedera Hashgraph distributed network uses a different data structure from the blockchain – a directed acyclic graph (DAG). Blocks with transactions in a DAG do not follow a strict linear sequence, as, for example, in the Bitcoin network. Instead, they are written to the ledger regardless of the order.

In a regular blockchain, miners compete to process the same transactions and tasks, in a sense wasting energy. On the contrary, Hedera Hashgraph blockchain allows for many parallel computations independent of each other. This is what increases the processing speed and energy efficiency of the network.

Blockchain is based on a “vertical architecture”, while DAG operates on a “horizontal” scheme. In a blockchain network, transactions are grouped into new blocks, which are then added to the blockchain chain. In the “horizontal” DAG network, transactions are directly linked to others by grouping them into blocks.

In this way, the DAG distributed ledger systеm allows the project to work faster and much more energy efficiently than the original blockchain systеm. This technology is also used in other crypto projects, but it is in Hedera that it is emphasized the most and implemented as deeply as possible into the very root of the systеm.

There is one more proof that Hedera Hashgraph is not a blockchain. Unlike a blockchain, where information is stored in blocks, Hedera Hashgraph stores information in hashes that describe certain “events,” i.e., transactions. That is why this project is called Hashgraph, because information is stored in hashes.

It is interesting that the consensus algorithm used in the Hedera Hashgraph network has been used in practice for over 35 years (in a slightly different form). And it is so well made that it has a “mathematically proven level of security”. That is, according to mathematical calculations, it is very difficult (if not impossible) to outsmart it.

This means that as long as less than one-third of the network participants do not want to deceive the network, the systеm will always be able to find a consensus on the state of the network and transaction history. It is believed that this is the highest degree of security that a consensus algorithm can provide.

What is the point? Why is this blockchain better?

The project developers claim that the main network is capable of processing more than 4.5 million transactions per day. Currently, the real throughput is 10,000 transactions per second, but thanks to the segmentation mechanism, the network’s potential is unlimited. HBAR holders pay $0.0001 per transaction, and verification takes three to five seconds. The energy consumption for processing each transaction does not exceed 0.00017 kW, compared to an average of 885 kW for Bitcoin and 102 kW for Ethereum transactions.

The Hedera Hashgraph platform supports the same object-oriented programming language used by Ethereum. Known as Solidity, which is commonly also used for smart contracts. By enabling smart contracts, the platform can be used to create decentralized applications (dapps). It is suitable for a variety of use cases, including games, decentralized finance (DeFi) products, digital identification, and more.

Therefore, there is no need to sacrifice functionality, the entire modern crypto world will feel great in the new technical realities without sacrificing convenience for the end user.

As a result, we have:

– In theory, potentially the fastest blockchain in the world, which is not inferior in security to its competitors.

– The most energy-efficient blockchain in the world

– The most scalable blockchain in the world

– The cheapest blockchain in the world

– In general, this is the best project ever created.

But there is a problem – all this is still only on paper :)

Currently, all of the above technological futures are at a very early stage. Few people know about it, and it is still far from being widely used. Even within the crypto world. But the technology, the idea, the mechanisms, which even in test modes outpace many of today’s technologies, are what makes this project interesting and intriguing.

The project itself also has a few drawbacks:

– Unlike many cryptocurrencies, Hedera Hashgraph is not open source. Instead, the technology is proprietary, which prevents developers from forking the protocol to create their own publicly available versions. Just as Bitcoin (BTC) was forked into Bitcoin Cash (BCH) and Bitcoin Cash into Bitcoin SV (BSV).

– With only 39 stewards, it is obvious that Hedera is not a decentralized cryptocurrency. However, each investor manager is a leading organization in the industry with a high reputation. So it is unlikely that they will do anything that is not in the best interest of the network, which they have a strong interest in achieving. But we will talk more about the internal management of the project itself later.

The technology is really promising, but it is very difficult to say how it will work in practice. Because it takes time to develop any technology and apply it. We can watch this happen. And also be among the first to witness the birth of the technology and, accordingly, take advantage of it to make money :)

Now let’s look at other aspects of the project. After all, you can promise a lot, but do you have the resources to fulfill what you said?

Investors and partners

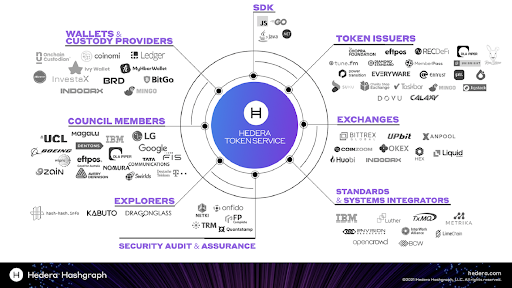

Obviously, such an innovative project cannot but have large investors and funds behind it. So Hedera Hashgraph ecosystem is very strong and has a large number of projects.

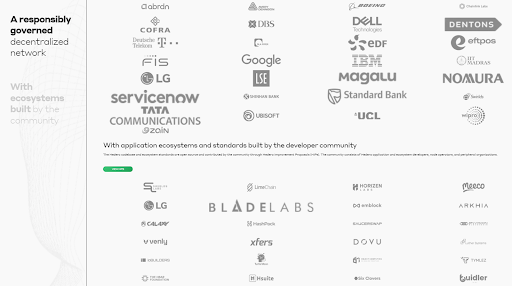

Since the completion of the ICO, Hedera Hashgraph has established partnerships and working arrangements with numerous firms and institutions in a variety of industries, including Boeing, LG, and University College London (UCL).

In February 2020, Hedera Hashgraph also added Google to its governing board. This may be their biggest partnership to date. As part of the agreement, Google will run Hedera’s network node and help participate in the management of the network.

They also have a partnership agreement with IBM Ventures Capital, the venture capital arm of IBM, one of the world’s leading technology giants.

The list of such major partnerships of Hedera is very impressive, and it will take a long time to talk about each of them. But we think that it is already clear how well the project “makes connections”.

Of course, Hedera Hashgraph partnerships is good, but…

What about the money?

In 2018, the company held a public ICO, during which it sold less than two percent of the total Supply for more than $120 million.

The token price for the ICO was $0.120, which is quite expensive. At the moment, it is about $0.05, and at its peak it reached $0.57.

The company also received funds in funding rounds from other individual investors:

– $18 million from Digital Currency Group (DCG) in 2018, during the ICO period.

– $100 million from BlockTower Capital, also in 2018.

– There was also a funding round with IBM alone in 2018, but the amount and other details were not disclosed.

– The last announced funding round was in 2021. It raised $3 million from Boeing, Tata Communications, and Centrum.

In total, more than $230 million was raised.

But we are sure that there may be much more money than the company claims. Since its policy is quite closed.

At the moment, the company’s total capitalization is more than $7 billion.

Tokenomics

If you want to invest in Hedera Hashgraph, you need to take a deep dive into the tokenomics of this project.

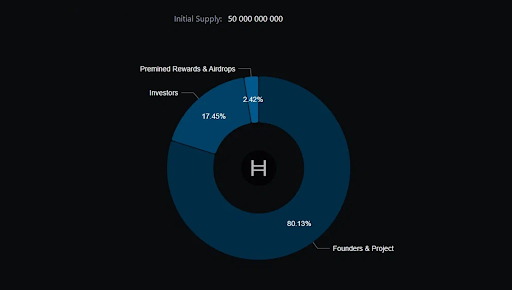

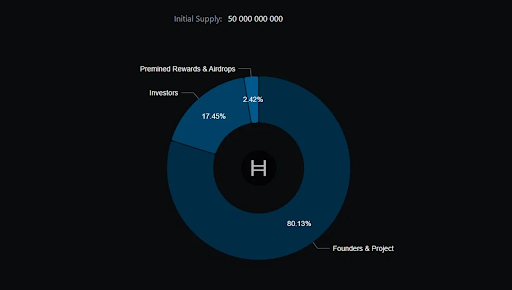

As for the project’s tokenization, everything is tied to the native HBAR token. The total issue is 50 billion coins. It is worth noting that Hedera Hashgraph tokenomics are distributed very reasonably.

More than 80% of all HBARs are held by the project founders. Early investors account for more than 17%, and free giveaways and community activities account for more than 2%.

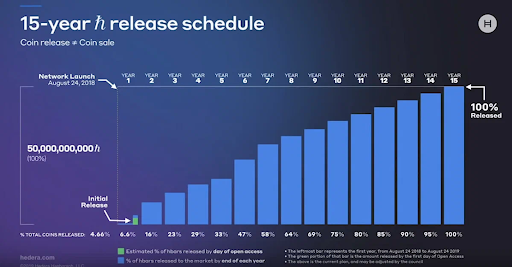

Another argument for the fact that the tokenization is very well developed is the coin distribution schedule. In order to maintain an optimal balance between supply and demand, all pledged coins will be unlocked gradually until 2033 (see the chart below).

Project history and team

The history of the Hedera project begins with the American computer scientist Lemon Byrd.

Prof. Byrd started working on Hedera Hashgraph with Mance Harmon in 2017 after assembling a management team and finding key investors.

As we mentioned earlier, the platform is managed by the Hedera Governing Council. It was formed in 2019 from several representatives of investors and partners.

As of the end of July 2022, 26 companies were members of the structure, including Boeing, Swirls, IBM, Nomura Holdings, and Ubisoft. The maximum number of executives is limited to 39 members. Their powers are valid for three years with the possibility of extension for two terms.

Since the Hashgraph technology is patented, unauthorized use of the Hedera code is subject to prosecution. According to the project team, this approach means that the network cannot be copied and launched by other crypto market participants.

Clients of Hedera Hashgraph

The target audience of Hedera Hashgraph is the corporate sector.

It is these corporate giants and part-time investors who sit on the company’s board of directors and make all the most important strategic decisions.

Competitors and the future of the project

Based on everything described in the article above, it is difficult to call Hedera technology and blockchain in the typical sense, not to mention a typical project. Therefore, to find competitors to this project, we need to take a slightly different approach.

In the technical part of this article, we talked mainly about the principle of operation of key Hedera mechanisms, such as DAG.

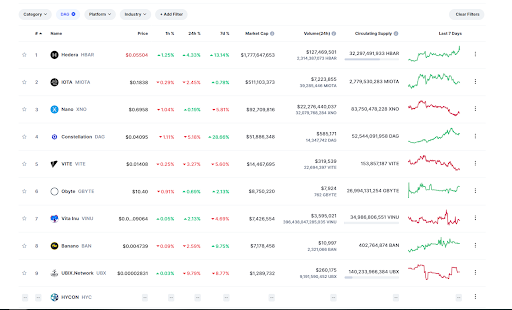

Therefore, when considering competitors, we need to pay attention to similar projects, i.e. those built on the DAG algorithm. Or those that position themselves as Hedera – not as a blockchain, but as a public network based on distributed ledger technology (DLT).

If we are talking about projects based on the DAG algorithm, there are few of them. About 15 are more or less alive. And if we look at those that are actively under construction and already have their own token, this number is generally reduced to 10. By the way, Hedera, as you might have guessed, is still in the lead.

It is this small number of projects that can be called Hedera Network’s competitors with a stretch.

Why with a stretch?

Because our current project is aimed exclusively at corporate use, integration into government agencies, etc. Corporations are its main customers and target audience. Other projects are likely to have a different business model. Therefore, they will compete in a different direction.

But if one of these DAG projects creates something that will overlap all of Hedera’s achievements, it will likely lose its leadership in this sector as well.

Therefore, the conclusion is that only sister DAGs can distort Hedera’s path to success.

So far, these projects are few and far behind Hedera. Therefore, we can confidently say that Hedera is the leading crypto project in its field.

Conclusions

It is very difficult to make a price prediction for Hedera Hashgraph, because on that influence many others factors.

It is difficult to say whether Hedera Hashgraph will really become the future of the entire crypto market. There are many other cryptocurrencies claiming this title. However, the idea of creating the fastest, safest, and most functional network is always relevant for developers of decentralized applications. In terms of the number of transactions per second, Hedera’s speed is quite capable of solving the scalability problem. The systеm also tolerates a large number of network nodes well. At this stage, we can only observe how Hedera will be implemented in real projects.

After analyzing Hedera Hashgraph, we can make a clear conclusion: it is very cool in terms of idea and execution. Yes, the concept is very unusual. Yes, this blockchain can be very competitive. And yes, it is backed by real tech giants represented by large companies, funds, and private investors.

What can go wrong?

It should be understood that considering Hedera for investment is still quite risky. Because the project is not about mass use, but about corporate and exclusive use.

However, the number of advantages that Hedera already has inspire confidence and arouse interest. It may well be that this is a dark horse in the crypto world that should not be overlooked. And which, although not for the most tangible amount, can definitely be in the portfolio of every crypto investor. But the final decision is up to each of you.

Well, we hope that this article has brought your final decision closer. It also helped you draw some conclusions, decide on further actions, and maybe you were just curious.

We wish you all the best and see you soon!